Many traders consider venturing into algorithmic trading but are often deterred due to its seemingly complex nature.

There is a mess of misinformation on algorithmic trading around the web which leads to individual traders dismissing it as too difficult or complex. This is unfortunate because algorithmic trading has a lot of upside potential and is becoming more accessible to individuals.

There are three different ways algorithms are used by traders. The first is for order execution; breaking down one large trade into smaller pieces to mitigate the risk and impact the trade will have on the market. These order execution algorithms are employed by large institutional investors, investment banks, pension funds, and mutual funds. The second is when a trader employs an algorithm to act on his/her behalf; entering into trades with pre-programmed instructions. This is accessible to individual and institutional traders alike. The third is when a trader uses an algorithm to discover valuable information in the market in order to find clear and actionable trading rules. This technique is also used by both individual and institutional traders.

In this post, we are going to explore the latter two types of algorithmic trading techniques and how we, as individual traders, can utilize them.

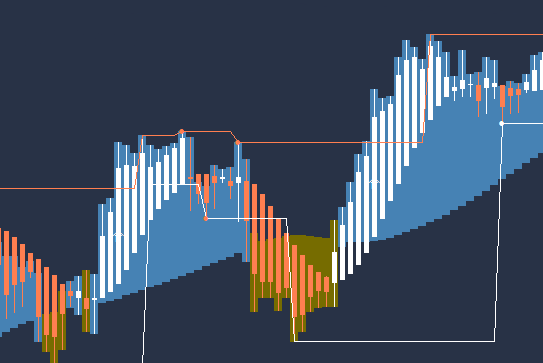

This is the most common form of algorithmic trading for individual traders. When we trade, we often have an algorithm that we use, though, it is not written in a language that your trading platform can understand. For example, if you are a technical trader and your strategy is to enter long when the RSI crosses over the 30 line and the 25 period EMA is above the 100 period EMA, the only thing that separates your strategy from an algorithm is automating it.

There are three major benefits to automating your strategy:

To automate your strategy, you will need to translate your strategy into a language that your trading platform can understand. There are many startups that are making algorithmic trading more accessible by making coding your strategy easier or eliminating it all together. Quantopian, QuantConnect and Equimetrics are good examples of this.

After I started trading, I researched commonly used technical indicators, like the RSI, MACD, Stochastic, Ichimoku, etc…, and how traders use them as trading signals. I soon found that if I went long every time the RSI was crossing above the 30 line, there were far too many false signals and I would lose money. Market data is very noisy.

What you can do instead of researching how to trade the RSI is use an algorithm to pick up on reliable and consistent patterns, or find the signals in the noise for you. This is particularly useful as markets change from say trending to sideways, as your strategy that was built for one may not work for the other. The idea is that certain algorithms are going to be much better at recognizing patterns in the enormous amount of available market data than you or I. We can use the algorithm to find patterns, then we can fine tune and explore the patterns to find clear and definitive trading rules. You are really taking advantage of what humans are good at; using intuition and domain knowledge to take action on trading opportunities, and what computers are good at; such as, sifting through enormous amounts of data.

This process is known as data mining and more specifically, association rule learning. Machine-learning algorithms are powerful algorithms commonly used to do exactly this. MATLAB and R are commonly used software applications for data mining, especially by quant funds. There is a bit of programming required but here is a step-by-step tutorial, with all the commands included, on using a machine-learning algorithm to find patterns in Apple stock by Tad Slaff. I am looking forward to releasing TRAIDE, which will allow us to mine US Equities, FX, and Bitcoin rates using macroeconomic, fundamental, sentimental and technical data without the hassle that comes along with MATLAB and R.

The seemingly complex nature of algorithmic trading often deters individual traders from applying it to their trading and this is unfortunate because there are a lot of benefits. Armed with the right tools, you can utilize algorithms in your trading. I would highly recommend taking advantage of these tools. The algorithmic trend is here to stay.