All too often we find ourselves in a new area of study, or this case, trading a new asset, with a steep learning curve and a hurdle of jargon to overcome.

PIP is an acronym for Point in Percentage. A PIP is a unit of change in the exchange rate of a currency pair. For all pairs that do not involve the Japanese yen (JPY), one PIP is the 4th digit to the right of the decimal, or the 1/10,000th place. For all pairs that involve the JPY, one PIP is the 2nd digit to the right of the decimal, or the 1/100th place.

Some brokers provide you with 4 decimal places while others provide you with 5. So the broker that provides you with 5 decimal places will have the last digit in an exchange rate quote be a fraction of a PIP rather than a PIP. A currency pair can fluctuate by .1 pips for 5 digit brokers and only 1 pip for 4 digit brokers. Ask Google how many digits your broker recognizes.

Different brokers allow for different position sizes. Micro lots are 1,000 units, often labeled 1k, of a currency. Mini lots are 10,000 units of a currency and a lot is 100,000 units of a currency. This is important to the definition of a pip because your position size, or the notional value, is used to calculate the value of each pip.

Step 1: (One pip, with proper decimal placement)/(exchange rate) x (*notional value) = value of a pip in the denomination of the **quote rate

*The notional value is the total value of a leveraged position’s assets. In other words, if you are entering a position of 1 micro, mini or standard lot, use 1,000, 10,000 and 100,000, respectively. If you are entering a position size of 2, double the notional value depending on the default position size for your account.

**The quote rate is second currency in a currency pair.

Step 2: To get the value of a pip in the currency in which you trade, simply multiple the result of step 1 by the exchange rate of the base pair and your currencies’ denomination. For example, I want to know the value of a pip in U.S. Dollars before I trade the EUR/GBP. I know the proper decimal placement of one pip, since the pair does not involve the JPY, is .0001 and the exchange rate is 0.79728. I also know that my account is a micro account so I use 1,000 as the notional value.

(0.0001 / 0.79728) x 1,000 = .12543

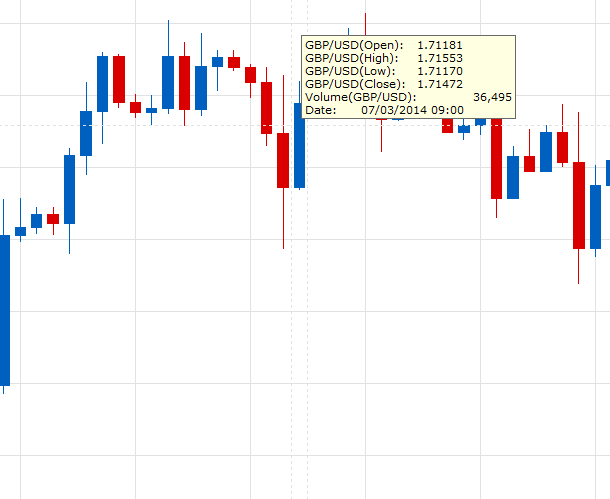

The value of one PIP is .12543 GBP since my quote price is the GBP. To get the value of one pip in USD, divide your answer by the current GBP/USD exchange rate so that the GBPs cancel out. The current GBP/USD exchange rate is 1.70771. In other words:

.12543 GBP / (1 GBP / 1.70771 USD) = 0.07345

If you don't feel like doing the math, here a quick tool for valuing a pip in any denomination.