The Federal Funds Rate is the overnight interest rate at which one bank lends funds held at the Federal Reserve to another bank. The Federal Open Market Committee (FOMC) establishes a target rate for trading in the federal funds market. The target has been set from 0.00 to 0.25% as of December 16, 2008. Every day the Federal Reserve measures and publishes the previous day’s effective federal funds rate known as the daily effective federal funds rate.

“The daily effective federal funds rate is a weighted average of rates on brokered trades.” [Source].

The FOMC meets periodically throughout the year to determine and announce the Federal Funds target rate. The next meeting is December 15/16th, 2015. Everyone knows the Fed is going to increase the Federal Funds rate target, but no one is certain when. There is a lot of speculation that the target rate will increase on December 15/16th.

Let’s see if we can draw some insight on when they are going to raise the rates by looking at the EUR/USD 1-day chart, and the daily effective federal funds rate, from before the FOMC changed the target rate on December 16, 2008 from a target of 1% to a target of between 0.00 and 0.25%, where it has remained since.

(Source: TradeStation II (EUR/USD 1-Day)

(Source: TradeStation II (EUR/USD 1-Day)

Now let’s see if either of these observations are present in today’s market.

Let’s take a look at the EUR/USD over the past few months to see if there has been a spike in volatility (using the ATR) and/or if the USD has begun to depreciate against the EUR.

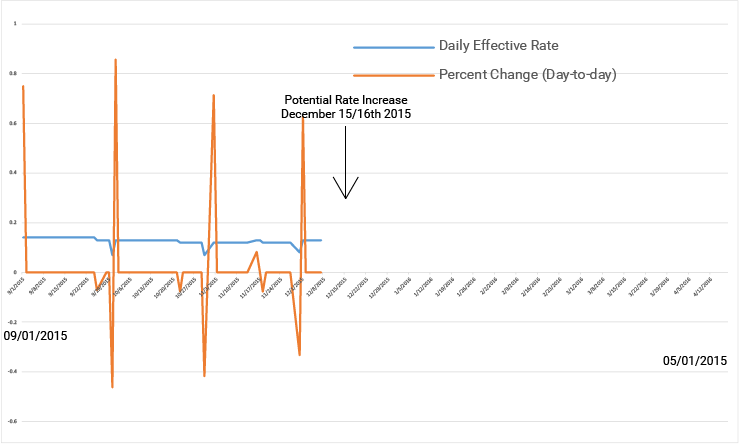

These two observations do not lend any evidence to confirm that there will be an interest rate rise on the 16th. Let’s take a look at another variable, the daily effect interest rate to see if we can see any evidence of an upcoming interest rate increase.

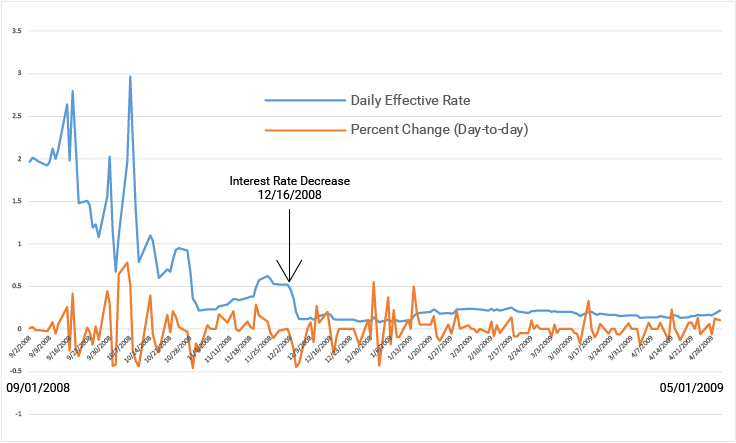

The daily effective federal funds rate is a weighted average of brokered trades on overnight interest rates between banks. In other words, the Fed sets a target and the daily effective rate is the actual rate measured in the market. Let’s look at the daily effective interest rate percent decrease over the same period and see if we can extract some general guidelines like we did with the EUR/USD 1-day chart.

Let’s take a look at the same variables from the months leading up to today:

Before writing this article, I would have said the Fed was going to raise the interest rate target on the 16th. After diving into the EUR/USD and the daily effective rate, I would say that the Fed is going to wait until January to raise the interest rate target.

EUR/USD is not behaving as I would expect (USD appreciation against the EUR) and low volatility and the volatility in the percent change in the daily effective rate from day-to-day is relatively flat and regular, suggesting the market doesn’t expect a change.

It is still a bit early to tell so we will see what happens in the next few days, but as of right now, there is no indication, other than speculation, that the Fed is going to raise rates. We’ll keep an eye on volatility as the FOMC meeting approaches.

We’ll also look at how you can trade the announcement and the daily effective rate with TRAIDE in the next article!