Macroeconomic, or fundamental, indicators measure the strength of an economy. The strength of a country’s economy influences the value of a country’s currency so it is no wonder traders follow major macroeconomic indicator news and announcements.

One of the most important macroeconomic indicators is a country’s interest rate. This article is an introduction to interest rates and how you can use interest rates in your trading.

Each country or region has a central bank. The central bank tries to control the money supply in a country’s economy to ensure stability and trust in the country’s currency. The central banks for the major currencies are:

| Currency | Country or Region | Central Bank |

|---|---|---|

| USD | United States | Federal Reserve |

| GBP | England | Bank of England |

| EUR | Europe | European Central Bank |

| JPY | Japan | Bank of Japan |

| NZD | New Zealand | Reserve Bank of New Zealand |

| CHF | Switzerland | Swiss National Bank |

| CAD | Canada | Bank of Canada |

| AUD | Australia | Reserve Bank of Australia |

To ensure stability the central bank will put in place a strategy known as the monetary policy. The main goal of the monetary policy is to control inflation which is a general increase in prices and a fall in the purchasing value of money. The central bank, of course, has other goals like decreasing unemployment, but keeping inflation in check is really its main concern. In the United States, the Fed sets a target inflation rate between two and four percent. A little inflation is good in a healthy economy.

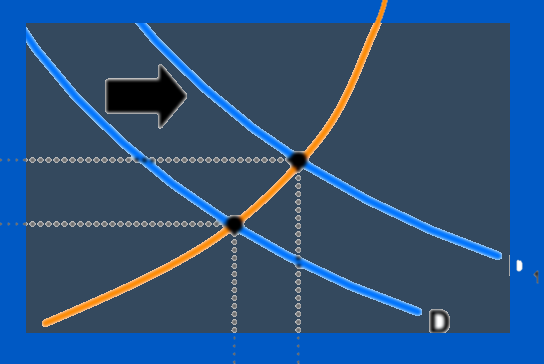

One way to reach target inflation rates is for the central bank to adjust the interest rate. In the U.S., the interest rate that is adjusted is for overnight loans to creditworthy institutions known as the federal funds rate. Lowering the interest rate promotes economic growth by making it cheaper for consumers and businesses to borrow money. This causes business and consumers to spend more and save less. Raising the interest rate retards economic growth by making it more expensive for consumers and businesses to borrow money.

The monetary policy can either be expansionary or contractionary. Expansionary policy increases the money supply in the economy while contractionary policy more slowly increases or even decreases the money supply in the economy.

To summarize, if inflation is rising too quickly, the central bank will implement contractionary monetary policy in which it increases the interest rate to slow economic growth and decrease inflation. If the economy is growing too slowly, not growing at all or growing negatively, the central bank will implement an expansionary monetary policy, which will increase economic growth and inflation.

One of the largest driving forces of the Forex market is the interest rate of a given currency. Changes in the interest rates can move the market immediately and dramatically.

Most traders don’t focus on current interest rates, they focus on where they expect the interest rates to go. Just like speculating on the price of an asset, traders will speculate on the interest rate; when will the interest rate change, in what direction and by how much?

You can make your own estimates and set your own expectations by looking at other economic indicators like:

Additionally, brokers, banks, funds and professional traders forecast interest rates. There are plenty of resources available that supply estimates and expectations. For example, Daily FX’s economic calendar does an excellent job of making macroeconomic news and announcements easily available and sortable.

Forecast the interest rates yourself or use a source you trust. As news and announcements become available, adjust your forecasts accordingly. Expect large market swings if the market’s participants’ expectations are different from the announced interest rates.

To capitalize on the news, you have to act very quickly. Before an announcement, watch the market; it will become more volatile up to an hour before the scheduled announcement and may last less than a minute after the announcement as the markets adjust. The bigger the surprise, or further from expectations, typically, the more volatile the market is going to be.

The difference between the two interest rates of a country is an important metric to keep an eye on. The interest rate differential is simply the difference between two currencies in one pair. For example, if the USD interest rate is .25% and the EUR interest rate is 1%, then the differential is .75%.

You want to buy the currency with the higher interest rate and sell the currency with the lower interest rate. In the Forex market, when you make a trade, you are buying the base currency and selling the quote currency. Using our made up example above, we would want to capitalize on the higher interest rate of the EUR. So, we would buy the EUR/USD; buy the EUR (base) and sell the USD (quote).

In Forex, the interest earned or owed is known as rollover. The type of trading that takes advantage of interest rates and the availability of high leverage in the Forex market is known as a carry trade.

Unfortunately, it isn’t as easy as just holding a high interest rate differential currency pair. The exchange rate is going to fluctuate based on a number of other factors, which is why it is important to stay up-to-date with news and announcements that will affect the currency pairs you are trading.

Also, your broker will do their own research into what to set the interest rates that they pay customers. You’ll notice that there is a spread on the interest rate and the interest rate set by the broker carries a premium to the interest rate set by the central bank.

This brief introduction to monetary policy and interest rates does not cover the many caveats of interest rates in the Forex market. Here are some other areas to research before building your carry trade strategy.

Every trader should understand how interest rates work. The more you understand about monetary policy how the rates are set by the central banks and your own broker, the easier you’ll find it to build a strategy that can take advantage of interest rates.

We are looking forward to incorporating interest rates into TRAIDE so you can quantify how they affect the currencies you trade. Stay tuned! I would love to hear how you incorporate macroeconomic indicators into your trading, especially quantitatively, so please leave a comment. In the next post, we'll be exploring exactly that!