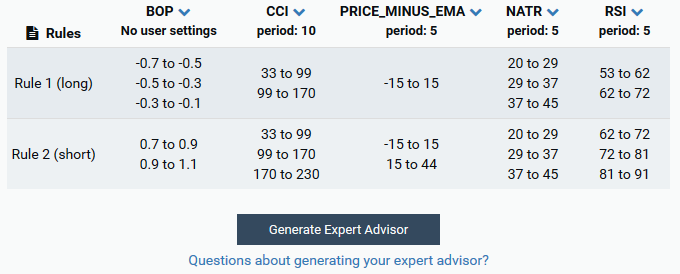

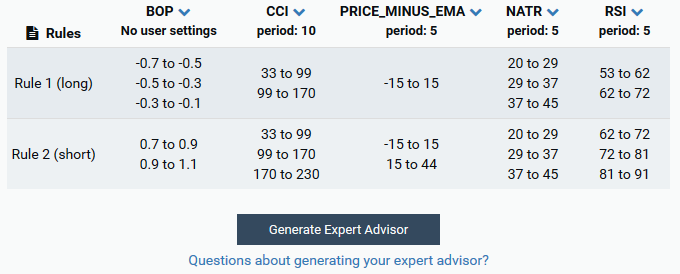

We’re going to build a strategy in TRAIDE, then export it to MetaTrader 4, using a normalizerd average true range (NATR) indicator for volatility- only trading in high volatility- and a Commodity Channel Index (CCI), Balance of Power (BOP), Exponential Moving Average (EMA) and price difference, and a Relative Strength Index (RSI) to time our entry.

Click here to see, play with and download the strategy as an MetaTrader 4 Expert Advisor (EA).

The strategy was tested on unseen, or out-of-sample, data in MetaTrader 4 to see how it would have performed on new data. Click here to see the full report.

While the final results above are from out-of-sample, or unseen, data, we need to build the strategy on historical data. TRAIDE is a powerful analytics tool designed to uncover patterns in complex financial data. We’ll use TRAIDE to build our strategy’s rules for going long and short. I love TRAIDE because you can test your ideas so quickly!

This strategy was built in TRAIDE in a couple of steps:

Then select your indicators:

Click on "run". You can then select the rules in the rules table below by clicking on a histogram bar for long or short.

We selected the data we wanted TRAIDE to analyze; the indicators, currency pair, timeframe, and date range. We then had TRAIDE’s machine-learning algorithms analyze the relationships in our data by clicking “Run”. We are then presented with the information TRAIDE uncovered and we selected the rules where we wanted to go long or short by selected histogram bins. After creating our rules, we exported our strategy to MetaTrader 4 where we tested our strategy on out-of-sample data. The strategy performed well and we were able to enhance it by adding a take profit and stop loss. Now that we are confident in our strategy and testing method, we can now trade this strategy on live rates.

Click here to see, play with and download the strategy as an MetaTrader 4 Expert Advisor (EA).